Sustainability issues are also financial issues. We are moving towards an increasingly transparent, digitised and sustainable future, in which companies must communicate material, coherent, comparable and useful information for decision-making, in both financial terms and regarding proximity and citizenship.

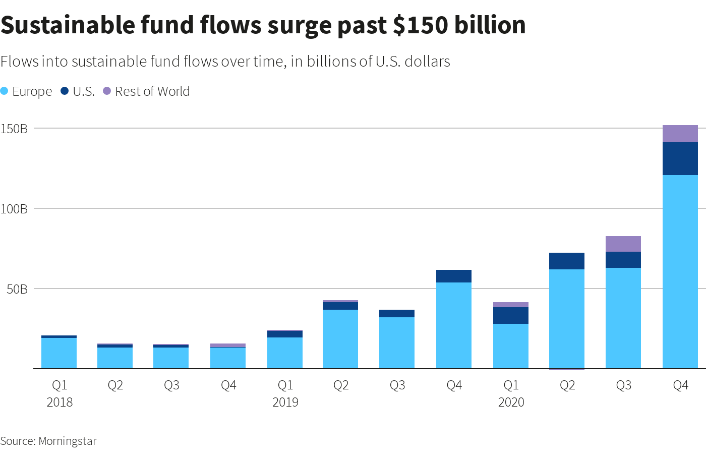

The volume of investments associated with sustainability criteria (investments based on environmental, social and governance criteria or ESG, green bonds, etc.) is increasing at an exponential rate. However, investors still believe that the information provided by ESG indicators is liable to greenwashing (EY, 2021), while financial rating institutions and regulatory authorities are constantly increasing their demands for information and data transparency.

Thanks to the integration of social foundations and the planet's limits, and their alignment with the main working areas in an operational framework of sustainability (climate change, equality, circular economy, just transition, biodiversity, health, emissions, energy) like the one presented in this series, a corporate accounting methodological framework based on the operations of the business in its real environment is being constructed. This framework provides a simultaneous, updated and coherent response to stakeholders, shareholders and market and regulatory initiatives as well as environmental, social and governance (ESG) indicators, the Taskforce on Climate-related Financial Disclosure, the Taskforce on Nature-related Financial Disclosure, and sector-specific standards.

Incorporating ICT into the sustainability model

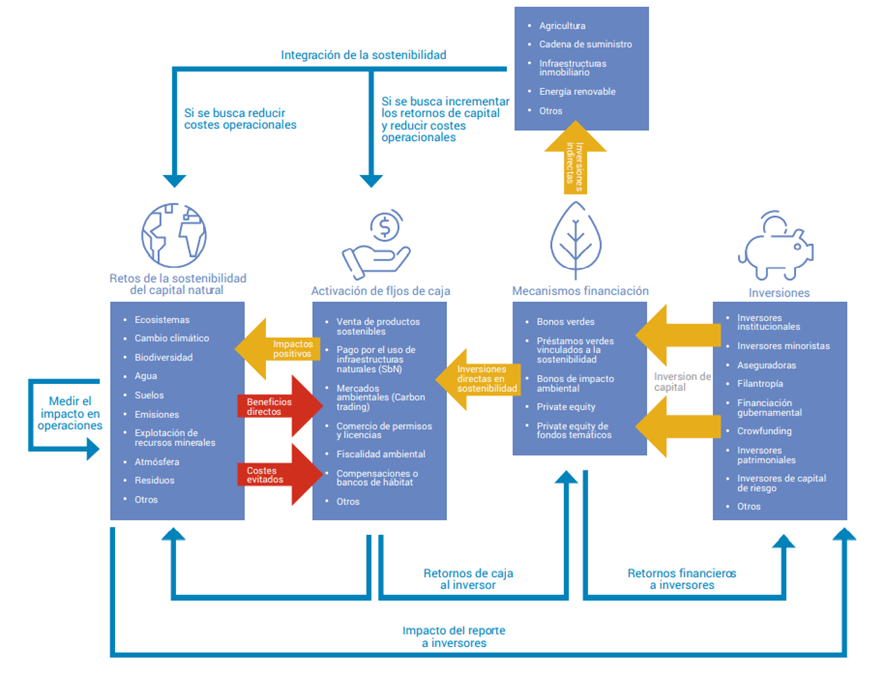

Incorporating information technology into an integrated accounting data governance model begins with the identification of robust, relevant and timely indicators that help to demonstrate the sustainability of a business model, and to transfer the value that is generated at its very base. These indicators will be of high quality when their spatial and temporal resolution enable operational decisions based on them to be made. The power that knowledge of end to end management of the data provides contributes to streamlining the strategic and operational management of the business, identifying opportunities which increase the value of corporate sustainability, and facilitating access to markets and green financing products. This is all as a result of reduced operational, industrial, environmental and social management costs, increased operational efficiency and the response to social demands for the reporting of sustainability, as well as a regulatory environment that makes increasing demands of the private sector.

Companies are able to shift their businesses towards genuine sustainability, and to demonstrate to their stakeholders and financial markets that the company's entire value chain is sustainable, safe and profitable. The power of operational data management and its alignment with corporate policies simultaneously contributes to improving the assessment of strategic risks, to identifying beneficial integrated solutions at a structural level which create shared social and environmental value, and to improving the exploitation of corporate performance, increasing the company's real value thanks to the total contribution of value by each of the six capitals that make up the value of a business.

The companies that understand how each element of their business contributes to a framework of ecosystem and social sustainability throughout their entire value chain are companies that are able to certify their double material impact. These organisations are better able to deal with physical risks, those arising from the transition and systemic risks, and are therefore able to lead and activate new sources of value generation by means of a responsible reduction in production costs, activating new cash flows for the provision of services, launching of eco-efficient products onto the market and gaining access to better tax conditions, among other possible benefits.

As a result of these new sources of value generation based on relevant, traceable and certifiable data, the organisation will be classified as responsible towards the environment and society (EU Green Taxonomy), and attract sustainable financing funds and institutional investors interested in high-impact sustainable portfolios in response to a material corporate report, with the consequent high scores obtained in rating mechanisms (ESG Best in class, DJSI, GRI and others), and access gained to better financing conditions in the market through new sustainable investment products (Green Bond Principles).