Cloud technology in the financial sector in 2022 and the added value of AI Labs

In 2022, the total amount of spending on IT services is projected to be around 1.3 trillion U.S. dollars worldwide and aside from all those that have already adopted it, studies show 60% of businesses intend to employ cloud computing in the next 18 months. The benefits of investing in cloud technology justify the investment with 94% of businesses reporting significant online security improvements after moving their data to the cloud.

With approximately 2.5 quintillion bytes of data created every day, cloud-based infrastructures are especially important for any financial enterprise that recollects sensitive information and countless data points about their customers such as banks. However, in order to maximize cloud computing and integrate it successfully in their business strategy, financial service companies require in-depth understanding of the latest technologies, capabilities, tools, and techniques that are offered by different Cloud providers which form the AI Cloud market.

The main cloud providers such as Amazon Web Services, Google Cloud, or Microsoft Azure, also known as hypersalers, continuously invest in extending their service catalog for AI development and cloud and have the capacity to scale the cloud capabilities of any entity.

In order to minimize the time and resources required to understand the best ways to leverage the AI cloud capabilities of hyperscalers for their particular business model, NTT DATA has created the AI Labs, a full-scale program that implements well-designed solutions through agile iterative processes that can drive experimentation and measure its progress.

So, what are AI Labs and how can financial institutions benefit from them?

AI Labs, the accelerator for rapid integration of AI cloud technologies for financial entities

The concerns over data privacy and security, giving up legacy on-premise applications, being compliant with all the new regulations, or the fear of losing control over systems when migrating them to the cloud, are just some of the challenges faced by financial entities when considering to incorporate AI cloud technologies in their strategy. These are also some of the reasons why the banking sector has been slower in incorporating advanced technologies than other industries.

However, this position is starting to change as more financial institutions realize how technology can help them meet their business objectives while satisfying customers’ needs at the same time.

The AI Labs were developed with a clear goal in mind: identify on behalf of financial entities the best combination of AI cloud computing technologies from different hyperscalers and scale their efforts with minimum effort and resources. AI Labs enables rapid experimenting of different cloud-available machine learning techniques and tools, across different business areas, for specific use-cases. They act as an independent yet integrated body that analyzes the generic business needs and end prototypes, that once validated, are productionized, and scaled.

The goal of AI Labs is to seamlessly integrate, update and elevate the ever-increasing AI/ML cloud capabilities of an organization's workflows at a smaller cost so that financial companies can reduce the cost associated with in-house research & development. This would allow banks to concentrate their talent and funding to search for the most adequate ways to solve the business challenges they face and thrive in this new technology era.

AI Labs offers solutions to NLP problems

A practical use case for AI Labs involves Natural Language Processing problems that stem from customer enquiries coming through a bank’s chat in their app. The customers chat with employees (not a chatbot), and the bank’s goal is to analyze those conversations, which can present different levels of complexity. AI Labs can help analyze the different scenarios a client might encounter when facing this type of problem. What technical considerations are important in an NLP problem? Which basic questions should the client ask before selecting a specific solution? These questions and every special consideration we can identify will allow us to choose correctly between using a cloud provider or working locally.

In this case, AI Labs will compare a pretrained model provided by the hyperscaler with a custom model trained by the bank. The examination will involve language models and include the use of a provider-managed solution and a more custom, AutoML solution.

The bank’s question is whether they should implement a complete analytical pipeline with a custom NLP model or whether it’s more efficient to use one of the services offered by cloud providers. There are two main dimensions that we need to take into consideration for this use case:

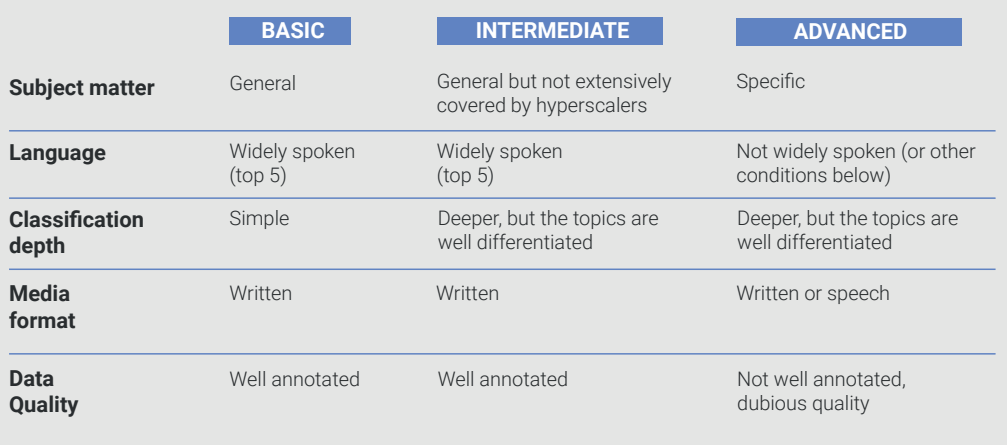

· The complexity of the different scenarios that the client may encounter when facing an NLP problem.

· The basic questions and technical considerations that the client should ask before selecting a specific solution.

In order to perform our analysis, we will consider a classification project to illustrate this idea:

AI Cloud solutions are in constant evolution and have reached a sufficiently high maturity level to have the potential to become a key piece in the AI strategy of any bank. In order to leverage the advanced capabilities of cloud technologies, financial institutions need to invest substantial time and resources in order to identify the best solution or hyperscaler to fit their needs. We’ve created AI Labs to help banks and other financial entities make the most of cloud AI technologies without having to deal with the complexities of developing the right solution, testing providers or integrating several tools.