Sustainability is rapidly becoming a foundational element of both organisational, marketing and business strategies for corporations of all sizes.

In recent years, ESG has become a commonplace term across banking and financial services. In essence, it is a metric used to measure the sustainability and social impact of investments into corporations. It includes three key areas of concern: environment (E), social (S), and governance (G).

NTT DATA Global Corporate Banking (GCB) takes a two-part approach to addressing rapidly evolving ESG market dynamics on behalf of its customers:

- We continue to invest in the development of dedicated services and software tools to support the Client Engagement based on ESG affairs with a vertical perspective for each industry of corporate banking clients.

- We take a ‘partnership’ approach with each client, tailoring advice and services on a case-by-case basis.

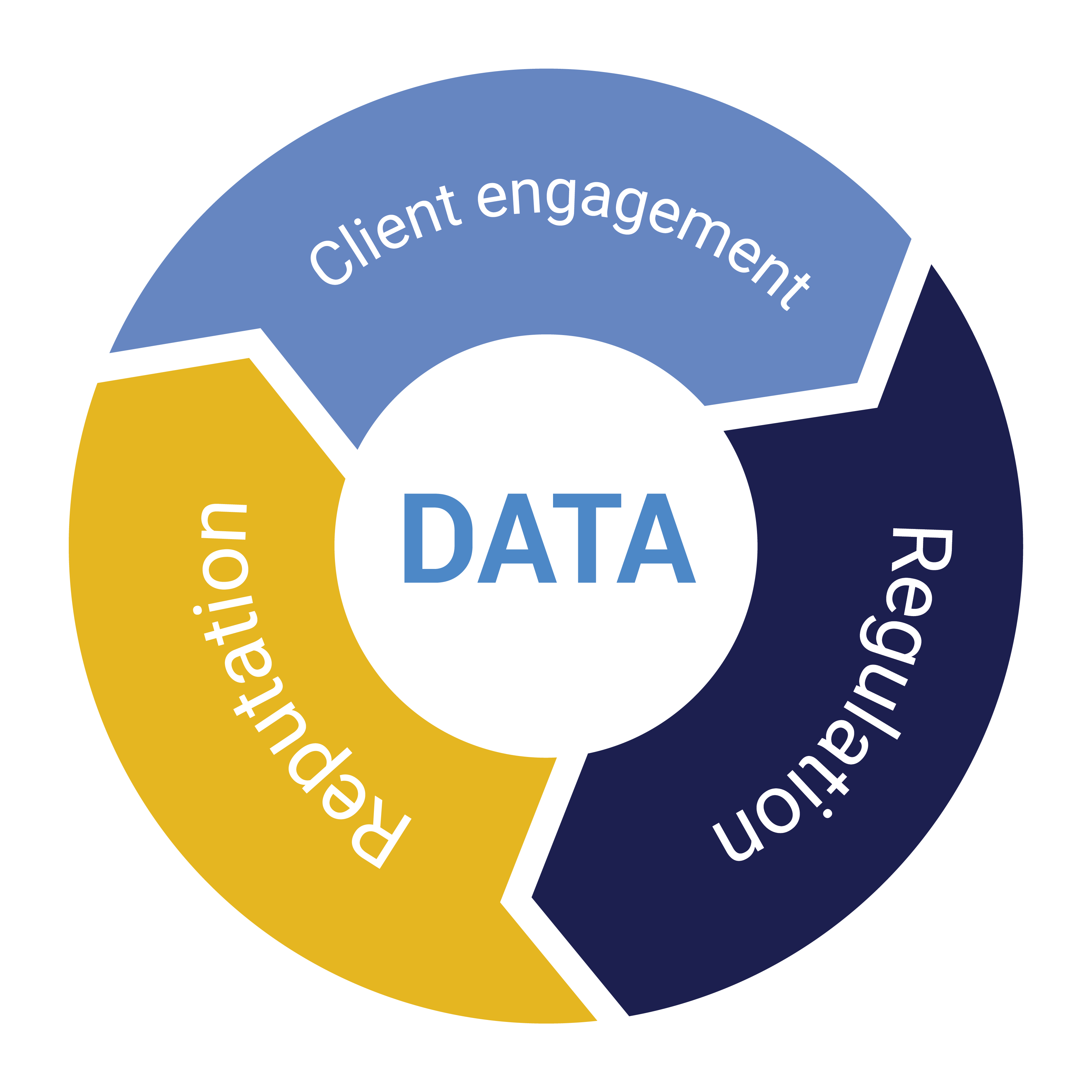

Whilst we certainly advocate a multi-faceted approach to ESG planning, the importance of keeping clients engaged cannot be overstated. In the section below, we’ve outlined the three vertices of a successful sustainability strategy and emphasised our belief in the strength of client engagement.

ESG is not only about reputation or regulatory affairs

In the past decade, there has been an evident shift in investor attention towards sustainability and sustainable business. As a result, ESG has become a crucial consideration for corporations across the globe.

As sustainability strategies are continuing to develop in line with investor demands, creating a clear plan of action can be challenging. To ease this process, NTT DATA have outlined three key areas of concern, as demonstrated in the graphic below:

The evidence suggests that investors engaging with companies on ESG creates stakeholder value. That’s why NTT DATA have outlined a clear strategy to prioritise client engagement moving forward, as bankers have to move on three steps with their clients:

- Understanding the challenges that their clients have along sustainability matters: climate risk, energy transition, etc.

- Sharing a long-term vision about the evolution of these challenges.

- Advising their clients in the way to face these challenges and proposing the best financing structures.

Moreover, regulation and reputation continue to be internal matters on which the Banks have to devote their time and resources, but also, they are aspects to take in mind to advice their clients in sustainability finance.

Finally, we’ve placed data at the heart of this strategy because we believe that it is the glue that holds all three components together. Used in the correct way, data ensures clear lines of communication between companies and their clients. Most importantly, it keeps investors engaged in corporate activity, particularly in relation to sustainable practices.

ambit: laser focused on client engagement

Part of NTT DATA’s focus in client engagement involves ambit, a new scenario-analysis solution that enables firms of all sizes to model the potential impact of climate change, CO2 emissions and other medium to long-term challenges. ambit helps to raise awareness of the financial impacts of each potential scenario, heightening the level of engagement with clients and ensuring clarity in client communication.

Through scenario analysis, ambit empowers corporates to take advantage of understanding the challenges and financing instruments to make strategic adjustments ensuring ESG compliance and risk mitigation, among others.

ambit is available for two use cases at the moment:

- Farm sector: modelling RCP scenarios and forecasting economic impacts in terms of capital, probability of default, investment to mitigate impacts, etc.

- Real State: based on CRREM, it allows analysis of energy consumption, carbon emissions… for each real state asset, forecasting economic impact for excess emission costs, visualizing the different project to mitigate the impacts as isolation, solar panels, etc. and proposing funding to address the projects selected.

These outputs help our customers identify potential ESG investment opportunities to help corporate in the transition journey to a more sustainable world.

Different regions and industries require different solutions. So, moving forward, it’s vital that solutions are flexible and adaptable to include new data, indicators or scenarios to achieve maximum engagement with clients across the globe and tech solutions like ambit help for it.

Client-centric partnerships

NTT DATA’s fundamental approach to corporate banking services is tailored to each customer’s needs, allowing maximum flexibility in response to the rapidly evolving commercial and regulatory landscape.

While the dynamic nature of both voluntary and regulatory ESG drivers alike makes a client-by-client service model essential, many ESG-specific corporate needs are similar enough that in every client relationship, we aim to deliver:

- End-to-end Services for Client Engagement: NTT DATA dispose a team specialized in ESG impact for different industries (energy, real state…) that accompany clients in advisory or strategy services. This service join to ambit gives our corporate banking clients a huge value to improve their client engagement in sustainability financing process.

- Aggregated Climate & Sustainability Data: Drawn from multiple sources into a single view, allowing our customers better overall visibility, risk assessment and efficiency in assessing the impact of each decision on credit ratings and investments.

- Climate Risk Analysis: Offering insights on physical and transitional risk, analyzing market behavior and reactions derived from the effects in the environment and applying these to the valuation various client portfolios. This is useful for banks advising clients and predicting how portfolios will behave under different modelled scenarios.

Utilising this internal resource allows the Global Corporate Banking division to support customers facing major decisions related to climate change and ‘green transition’, including, among others:

- Mapping/taxonomy of ongoing changes in regulatory environment.

- Transformation towards a decarbonized economy.

- Limits on carbon emissions.

- Technological changes.

ESG: future opportunities for success

As we navigate the huge variety of changes to the ways we live and work, NTT DATA’s Global Corporate Banking team continues to develop ESG-focused tools and services for its customers. These tools are designed both to ensure regulatory compliance in the present and near-term future, and to help customers understand and analyse potential risks and opportunities arising from environmental concerns.

NTT DATA’s commitment to the evolution of a more sustainable global economy dictates that the tools like ambit and our partnership-based service approach are in continuous development, reflecting the highly dynamic and interconnected environmental, social, and governmental drivers shaping economic and environmental policy around the world.

For all corporate financial services customers, the Global Corporate Banking team offers an end-to-end ESG support framework designed to feed into corporate ESG strategy, and to support that strategy through execution and regulatory certification.

Together, these tools and services act as accelerators for the bank in its provision of providing ESG-compliant financing products and added value to its customers.

In the future, NTT DATA’s top priority is engaging clients with ESG as much as possible. The facts are clear: all parties benefit from increased levels of engagement. Now, it’s time to act on those facts and implement successful sustainability strategies. Corporations must be ahead of the game in adapting to a rapidly changing world. Just investing into ESG isn’t enough. Understanding the how and why behind ESG strategy is the key to future success.